Irs lump sum pension calculation

In other words if you were to take the lump sum and invest it on your own youd have to earn an. Any spousal pension amount is calculated based on amount entered here.

3 14 1 Imf Notice Review Internal Revenue Service

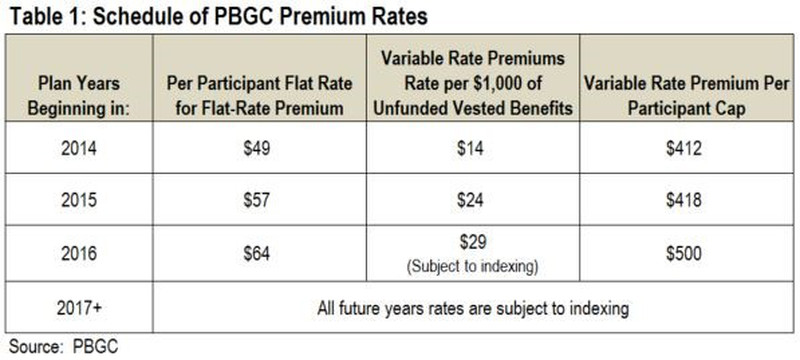

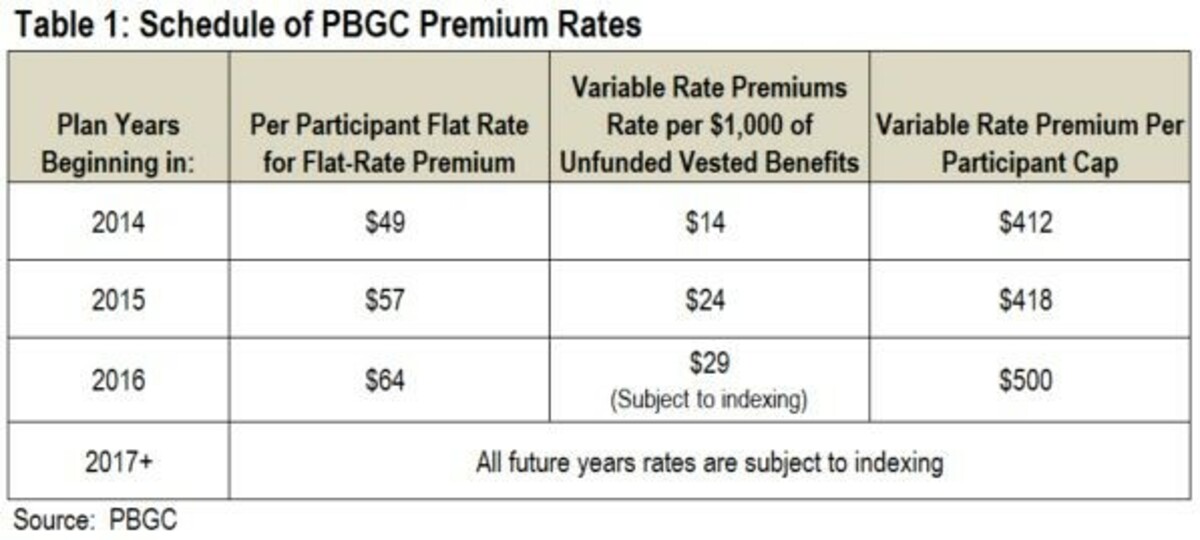

Funding Table 2A lists the 25-year average segment rates determined under Section.

. How is lump sum pension payout calculated. A simplified illustration. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated.

Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. We have the SARS tax. Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you.

Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you. Ad Could increased liquidity give you more control over your 500K in retirement savings. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. A simplified illustration. Your lump sum money is generally treated as ordinary income for the year you receive it rollovers dont count.

Begin Saving For Your Retirement Today - Your Future Self Will Thank You. For a defined benefit occupational pension scheme you may be able to. In the US the most popular defined-contribution DC plans are the 401 k IRA and Roth IRA.

Ad Discover New More Personalized Approach To Helping You Plan Your Retirement With Merrill. Funding Tables 2A and 2B. You will pay taxes on your lump-sum payout.

Ad Get Started With Our Free Online Chat - It Only Takes Three Minutes and is Easy to Use. Get The Flexibility Visibility To Spend W Confidence. Ad Could increased liquidity give you more control over your 500K in retirement savings.

If you want the full amount of your lump sum pension invested in your retirement account youll. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Lump Sum pension payout The lump sum that you would receive instead of guaranteed monthly.

When that happens you only receive 80 of your lump-sum distribution. For RACs PRSAs and people transferring to ARFs at retirement the lump sum limit is 25 of the retirement fund. 25-Year Average Segment Rates and Permissible Corridors.

How is lump sum pension payout calculated. To calculate your percentage take your monthly pension amount and multiply it by 12 then divide that total by the lump sum. DC plans are now the most popular pension plans in the US especially in the private sector.

Access Schwab Professionals 247. To calculate your percentage take your monthly pension amount and multiply it by 12 then divide that total by the lump. Readers with particularly long memories will recall that last year the state of Illinois instituted a lump sum cashout program in which in order to reduce its pension liabilities it.

If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus. This amounts to an annual return of 517 percent if you live another 20 years.

3 14 1 Imf Notice Review Internal Revenue Service

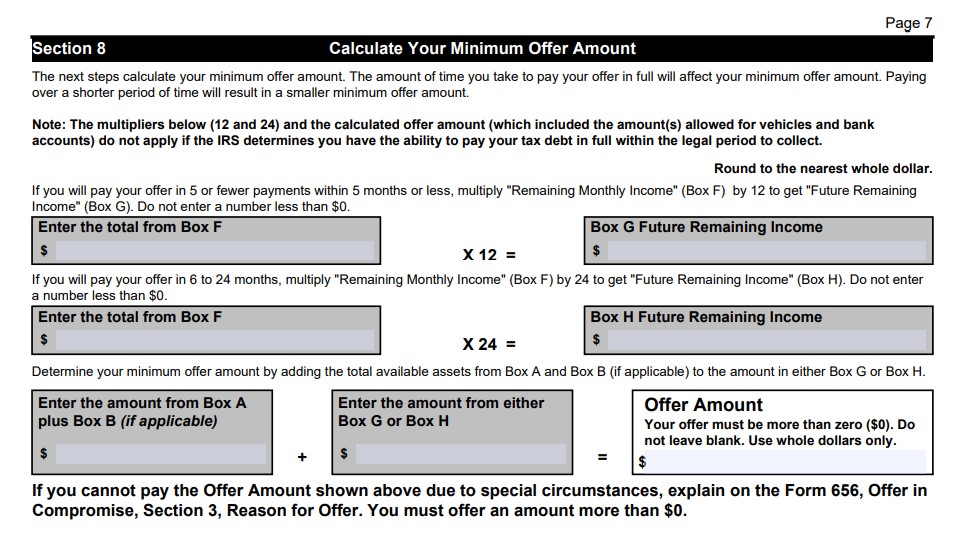

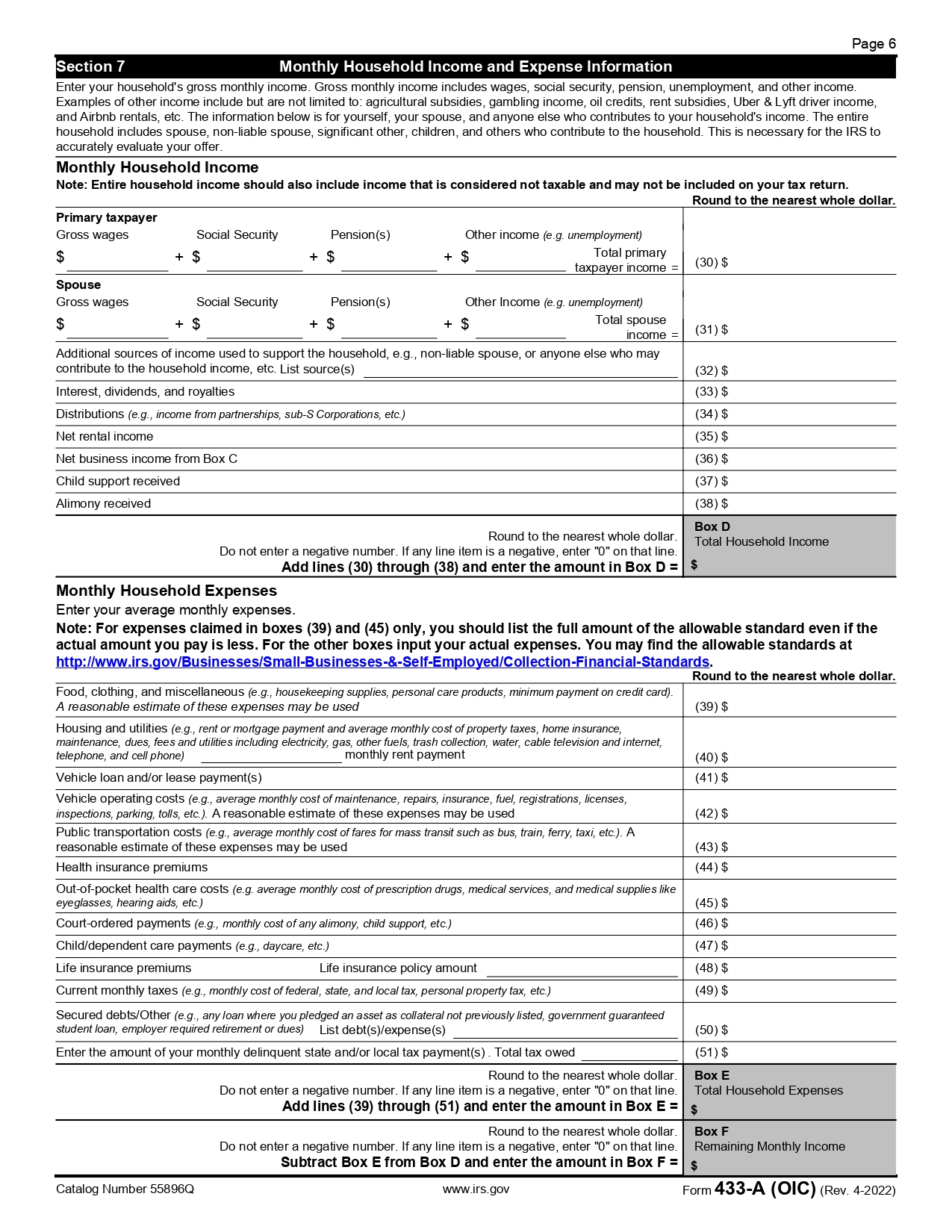

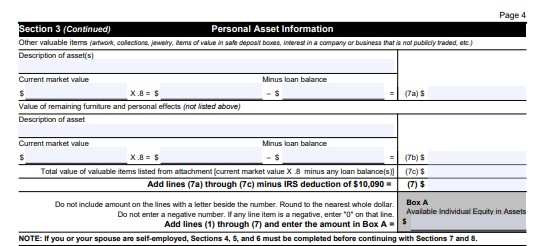

How To Fill Out Form 433 A Oic 2022 Version Detailed Instructions From Irs 656 Booklet Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

3 14 1 Imf Notice Review Internal Revenue Service

Backdrop

3 14 1 Imf Notice Review Internal Revenue Service

3 14 1 Imf Notice Review Internal Revenue Service

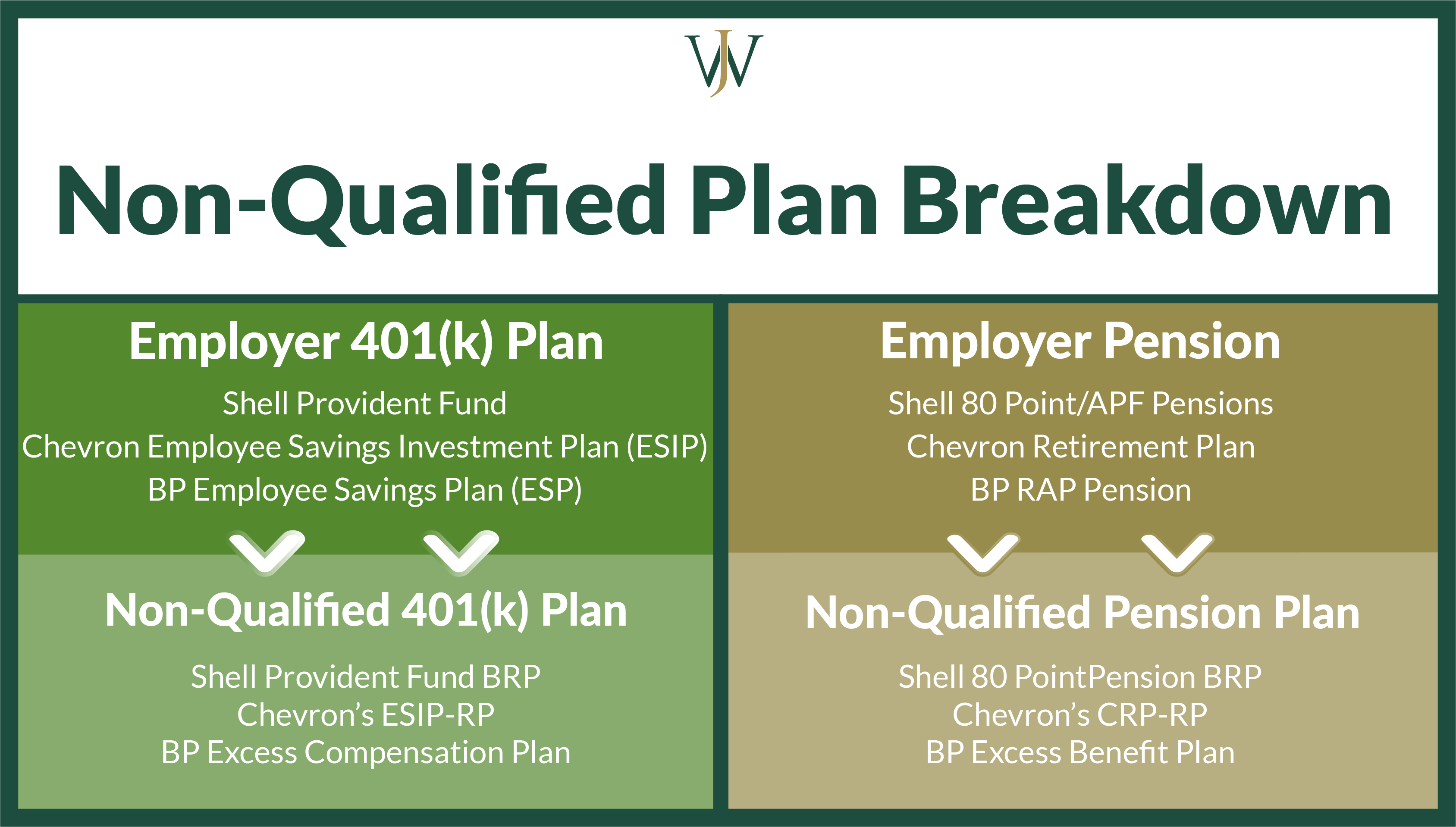

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

Tips For Making A Lump Sum Pension Payout Offer Cfo

Shell Professionals Benefits Willis Johnson Associates

.png?width=542&name=Fwd-HUGE-Drop-again-on-PPA-Rates-Jul-20-0-59-2-25-3-01-j-mccaffrey-retiregroup-com-The-Retirement-Group-Mail%20(1).png)

A Sharp Increase In Chevron Interest Rates Cause Lump Sums To Decrease

3 14 1 Imf Notice Review Internal Revenue Service

3 14 1 Imf Notice Review Internal Revenue Service

Tips For Making A Lump Sum Pension Payout Offer Cfo

How To Fill Out Form 433 A Oic 2022 Version Detailed Instructions From Irs 656 Booklet Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

How To Fill Out Form 433 A Oic 2022 Version Detailed Instructions From Irs 656 Booklet Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

2